Courtesy of Joseph A. Smith Jr. and Lee Reiners

This case study draws primarily – and in some instances quotes verbatim – from the 113 page report of the Wells Fargo board’s independent investigation of retail banking sales practices. The case study also relies on the Office of the Comptroller of the Currency’s report titled: Lessons Learned Review Of Supervision Of Sales Practices At Wells Fargo. Additional details are sourced from various Wells Fargo regulatory reports. The case study is intended to be used as a resource for directors at banks and financial services institutions of all sizes, so that they may learn from, and hopefully avoid, mistakes that were made over many years throughout Wells Fargo’s corporate hierarchy. All errors are our own.

CASE STUDY: Wells Fargo Fraudulent Accounts Scandal

Wells Fargo Bank, N.A. (“WFBNA”) is a nationally-chartered bank subject to federal regulatory oversight and examination, including by the Office of the Comptroller of the Currency (“OCC”), the Federal Deposit Insurance Company (“FDIC”), and the Consumer Financial Protection Bureau (“CFPB”). WFBNA is an indirect, wholly-owned subsidiary of Wells Fargo & Company (“WFC”), a financial holding company and a bank holding company (“BHC”), subject to Federal Reserve regulatory and supervisory authority. Combined, WFBNA and WFC constitute Wells Fargo.

Product of a storied tradition and history of industry-leading operating excellence, Wells Fargo has run into trouble. Wells Fargo’s board and management now face the daunting task of how to deal with the Bank’s current difficulties.

Background

Wells Fargo was founded during the California Gold Rush of the 19th Century. For more than a century, the Bank epitomized safety, soundness, and the frontier spirit, and developed a solid business and commercial franchise that centered in the western United States. To extend that franchise, Wells Fargo merged in 1998 with Norwest Corporation (Norwest), a Midwestern banking organization that excelled in business, commercial and retail markets, and began a geographic expansion with the goal of being a truly national bank.

While the merged bank operated under the Wells Fargo name, it was clear from the start that Norwest’s management culture, and personnel, were directing the combined firm. Under the post-merger regime, a number of operating principles were foundational:

- The Bank is a business with the objective of generating double digit revenue and income growth every year.

- The Bank operates on a decentralized model, with business heads encouraged to “run it like you own it.”

- The Bank’s relationship with customers is a business relationship in which the Bank’s obligation is to provide services the client needs efficiently and profitably. While the Bank’s treatment of customers must be fair, such treatment is in the Bank’s interest and an aspect of overall top-quality customer service.

- That which can’t be measured can’t be managed and, accordingly, the Bank instituted a rigorous performance management system based on the achievement of obsessively measured performance metrics.

- Acceptable customer profitability could not be achieved unless and until the customer was receiving multiple services and would not be optimal until the customer had eight or more services.

- Based on the operating principle just mentioned, the Bank (and the other financial services operations that were held by WFC) was infused with a sales culture that vigorously promoted the cross-selling of services. Opening of new customer accounts was rigorously tracked by Wells Fargo’s operating systems; success was rewarded with bonuses; lack of success with “enhanced training” or termination.

As a result of its core retail focus and management discipline, Wells Fargo weathered the ups and downs of the 1980’s and 1990’s better than most of its competitors. It was in a particularly strong position at the onset of the financial crisis, which enabled Wells Fargo, in 2008, to acquire Wachovia Corporation, a revered name in banking that had fallen on hard times as the result of loose lending and improvident acquisitions, including the indirect acquisition of Golden West Financial Corp. (Golden West), parent company of World Savings Bank, a large savings and loan that had financed the acquisition of California residential real estate at astronomical (and ultimately illusory) prices.

Wells Fargo had ups and downs during the Financial Crisis. While it sought to decline TARP infusions of capital, Wells Fargo’s management was ultimately persuaded to accept TARP funds after frank and fair exchanges of views with the Treasury Department and the Office of Comptroller of the Currency (OCC), its primary federal regulator. Its residential mortgage lending activities (much of which came from the Golden West acquisition) resulted in threatened litigation by state and federal agencies, and a burdensome and expensive settlement.

Wells Fargo’s basic business remained sound, and it came through the crisis relatively unscathed. It paid back the TARP money, weathered the settlement, and came out of the crisis in a relatively strong financial position. It had a national franchise, a proven business model, and strong capital. It was a stock market favorite whose largest shareholder was the legendary investor Warren Buffett. Its prospects looked bright.

Then something strange happened.

Wells Fargo’s Identity Crisis

The core of Wells Fargo’s operating strategy was its large retail distribution network, operating out of the Community Bank Division, and comprised of physical branches (called “stores”), and alternative delivery channels such as telephone, free-standing ATMs, and the internet. As noted above, the objective of this system was to generate new customer relationships and to expand, to the maximum extent possible, the number of products and services sold to existing customers. The scale of the system had grown by acquisition, but Wells Fargo’s management had insured that its IT systems expanded to cover this growth effectively. While the Community Bank’s management had also grown, it was well-trained in the Bank’s management philosophy and in the use of the Bank’s systems. This cohesion was buttressed by the fact that the top leadership had worked together for years at Norwest and, as a result, had implicit trust and confidence in each other.

Wells Fargo’s financial success reinforced its commitment to a decentralized organizational structure, and enhanced the status and authority of division heads, particularly the head of the Community Bank, which was the Bank’s main profit engine. The decentralized model also influenced the design and execution of the firm’s control functions. Many of the Bank’s centralized control functions had parallel units in the lines of business, with dual lines of reporting. For instance, each line of business had its own chief risk officer who reported directly to the head of the business line, and had a secondary (dotted line) reporting line to the head of Corporate Risk – the Chief Risk Officer. A similar decentralized structure existed for Human Resources.

The Bank’s decentralized structure gave the head of the Community Bank near unlimited discretion in establishing sales goals, and management at all levels were remorseless and relentless in pursuit of these goals. The Community Bank’s leadership acknowledged the improbability of reaching these goals, referring to them at times as 50/50 plans, meaning that they expected only half the regions would be able to meet them. Nonetheless, at each level in the hierarchy, employees were measured on how they performed relative to these goals. They were ranked against one another on their performance relative to goals, and their incentive compensation and promotional opportunities were determined relative to those goals. In some cases, employees were dismissed for failing to meet sales goals. Turnover in the Community Bank was high relative to peers, but because of the sales culture, management considered this turnover to be in line with that of non-bank retailers, and therefore acceptable.

Over the years, signs did emerge that aggressive sales goals were having some deleterious effects:

- In 2002, the Community Bank, noticing an uptick in sales practice violations, established a sales integrity task force which lead to additional employee training and a modification of incentive plans to reduce the promotion of bad behavior.

- In the summer of 2002, Wells Fargo’s Internal Investigations unit determined that almost an entire branch in Colorado engaged in a form of “gaming” in connection with a promotional campaign in the second quarter of 2002. In some instances, such “gaming” involved employees issuing debit cards without customer consent.

- In 2004, Wells Fargo’s Internal Investigations group drafted a memorandum noting an increase in annual sales gaming cases — defined as the manipulation and/or misrepresentation of sales to receive compensation or meet sales goals — from 63 in 2000 to a projected 680 in 2004. The memorandum noted a similar increase in terminations, from 21 in 2000 to a projected 223 in 2004.

- Beginning in 2005, the Wells Fargo board of director’s Audit & Examination Committee began receiving regular Audit & Security Reports indicating that the highest level of complaints to the firm’s internal EthicsLine were related to sales integrity violations.

- In 2010, Wells Fargo’s primary regulator, the OCC, issued a Matter Requiring Attention (MRA) requiring an enterprise-wide system for complaint management. This MRA was addressed to the firm’s management and not to the board.

- Also in 2010, OCC examiners asked the head of the Community Bank about the 700 cases of whistleblower complaints related to the gaming of employee incentive plans. The head of the Community Bank responded that the primary reason for the high number of complaints is that the culture encourages valid complaints which are then investigated and appropriately addressed.

- In 2011, Wells Fargo terminated 13 bankers and tellers in a branch in California for engaging in the manipulation of teller referral credits.

Despite these warning signs, the incentive compensation structure within the Community Bank remained largely unchanged. In fact, the Division doubled down on the program in 2010 by aligning performance management and recognition with sales goals, so that incentive compensation and performance rating were both associated with sales. This effectively meant that bankers, branch managers and district managers who did not meet sales goals not only could miss out on opportunities to earn incentive compensation, but were also at risk of poor performance reviews.

Questions

- Do you agree with the premise of Wells Fargo’s operating philosophy that a banking organization is a business like any other? Are financial firms different, and, if so, how?

- If you were on Wells Fargo’s board, would you have expressed concern about the control environment and the firm’s culture?

- How are board members supposed to get an accurate picture of Wells Fargo’s culture?

- Should profitability have any influence over how a board responds to potential issues arising from a firm’s culture or control environment?

Wells Fargo’s Board of Directors

Wells Fargo has a 15-member board of directors, comprised of intelligent and accomplished people from a variety of backgrounds. Until December of 2016, the offices of board chair and CEO were held by the same individual, a full-time executive of the firm. The remaining board members were independent and, through 2016, were led by a lead independent director. Nine of the independent directors had been in place for at least five years, with the remaining five independent directors having anywhere from one to four years of experience on the board. Six of the independent directors had experience in financial management or financial services according to Wells Fargo’s 2015 proxy statement. Each board member is elected to a one-year term and is eligible for reelection at the annual shareholders meeting. In 2014, nine of Wells Fargo’s independent directors served on three or more public company boards, as shown in Table 1 below.

Committees of the board include the: Risk Committee, Audit & Examination Committee (A&E), Credit Committee, Corporate Responsibility Committee, Human Resources Committee, Finance Committee, and Governance & Nominating Committee. According to Wells Fargo’s 2015 Annual Report on Form 10-K, each board committee “works closely with management to understand and oversee the Company’s key risk exposures.” The Risk Committee serves a unique role, as it is designed to assist the board’s other standing committees as “they consider their specific risk issues.” From the 10K:

“The Risk Committee includes the chairs of each of the board’s other standing committees so that it does not duplicate the risk oversight efforts of other board committees and to provide it with a comprehensive perspective on risk across the Company and across all individual risk types.”

“In addition to providing a forum for risk issues at the board level, the Risk Committee provides oversight of the Company’s Corporate Risk function and plays an active role in approving and overseeing the Company’s enterprise-wide risk management framework established by management to manage risk, and the functional framework and oversight policies established by management for each key risk type.”

The Audit & Examination Committee also plays a critical role in establishing and maintaining the firm’s risk management framework beyond selecting and evaluating the firm’s outside auditors. The A&E Committee oversees the firm’s legal and regulatory compliance, reviews regulatory examination reports, and oversees operational risk.

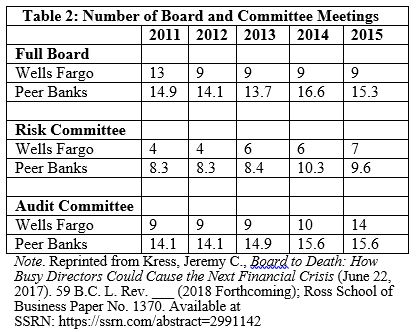

As indicated in Table 2 below, Wells Fargo’s board, as well as the risk and audit committees, meet less frequently than those of other large banking organizations that comprise Wells Fargo’s peer group.

Wells Fargo’s sales practices became a public issue in December 2013, when the Los Angeles Times published a report that customers of Wells Fargo in the area were reporting receipt of account statements for accounts of which they had no knowledge. Worse, some of these account statements assessed fees and charges for activities in which the statement recipients had not engaged. Aggrieved customers complained to Wells Fargo and, getting little or nothing, went to the local District Attorney, the State Attorney General, and the Bank’s regulators.

Wells Fargo’s board felt blindsided by the allegations contained in the LA Times report. Prior to the report, sales practice issues had not been previously flagged as a noteworthy risk to the full board or any committee of the board. Sales conduct or “gaming” issues had previously been mentioned in two sections of the quarterly packet for the A&E Committee, however they were not flagged as a noteworthy risk.

Questions

- Do you have concerns about the number of external engagements Wells Fargo’s board members have? If yes, why?

- Upon reading the LA Times story, what actions should Wells Fargo’s board of directors take?

- Should there be a materiality threshold before the board expects to be informed about a potential problem?

Post-LA Times Story

After the LA Times report, the chair of the board’s Risk Committee instructed Wells Fargo’s Chief Risk Officer (CRO) to take the lead in addressing the sales practice issues and to keep the Risk Committee informed of Corporate Risk’s efforts. Sales practices and the cross-sell strategy were identified as a noteworthy risk issue to the Risk Committee and the full board for the first time in February 2014, but they were not mentioned in the Executive Summary, which covers the most important enterprise risks. That same month, the HR director and the CRO reported to the board’s Human Resources Committee that action plans were in place to address the issue and that further monitoring of sales practices was warranted. However, they also reported that they did not feel it was necessary to adjust executive compensation for the 2013 cycle for sales integrity matters, a recommendation which the board followed.

At the full board meeting in April 2014, the CRO reported that sales practices had now become a current focus for the Corporate Risk Division, and at the August Risk Committee meeting, the CRO and CEO reiterated Wells Fargo’s focus on ensuring its cross-sell strategies were consistent with the development of long-term customer relationships.

Throughout 2014, the board and Risk Committee received assurances from the Corporate Risk Division, the Community Bank, and HR that sales practice issues were the subject of heightened attention, that the control environment was operating effectively, and that the situation was improving. Because of perceived improvements, in February 2015, the Noteworthy Risk Issues report reduced sales conduct from High to Medium risk, stating that management was “build[ing] out additional second line of defense oversight of Sales Practices.” Also in February, the Audit Function reported that no issues were found in its audits of Wells Fargo’s sales practices and cross-sell, which were rated effective with no reportable issues. That same month, the Human Resources Director and the CRO advised the Human Resources Committee that the Community Bank had taken appropriate actions to address sales integrity issues, and therefore, there was no need to adjust downward executive compensation for the 2014 performance cycle.

In April of 2015, the head of the Community Bank addressed the Risk Committee for the first time. She discussed the improvements in risk management that had been made in the Community Bank and reiterated her view that the problem was a result of a few bad apples, and not a reflection of a broader cultural problem within the Community Bank.

In May of 2015, the Los Angeles City Attorney filed a lawsuit against Wells Fargo based on the Bank’s alleged fraudulent and abusive sales practices.

Post-Lawsuit

After the lawsuit was filed, the chair of the Risk Committee demanded a presentation concerning the issues alleged in the lawsuit and the broader context of sales practices at Wells Fargo. An early draft of the presentation – which was never delivered to the Committee – disclosed that approximately 1% of employees in the Community Bank had been terminated for sales integrity violations in 2013 and 2014. After the Community Bank’s management questioned the validity of this number, it was removed from the final presentation that was delivered to the Risk Committee. Instead, during the May 2015 Risk Committee meeting, the head of the Community Bank informed the committee that in 2013 and 2014 combined, 230 employees had been terminated for sales abuses, and that 70% of these employees had been terminated for intentionally inputting incorrect customer phone numbers into the systems, while the remaining 30% were terminated for improperly funding unauthorized customer accounts from authorized accounts. The Risk Committee was surprised by the presentation and considered the 230 number to be high. Some managers within Wells Fargo knew the actual number to be much higher. The head of Wells Fargo’s Internal Investigations Division, who reported to the head of Corporate Security, had lobbied for the presentation to cite 2,500 employee terminations for sales practice issues in 2013 and 2014. The head of the Community Bank, along with the Community Bank’s CRO, vigorously pushed back against these figures which were ultimately left out of the presentation.

At the full board meeting in June, the CRO – who was away on vacation during the May Risk Committee meeting – informed the board that Corporate Risk would be conducting a comprehensive review of the Bank’s sales practices and that a third-party consulting firm would also be brought in to conduct an independent review of Wells Fargo’s training, compensation, and sales practices.

The results of the consulting firm’s review were presented to the board at their October 2015 meeting. During this meeting, the board also received an update from the head of the Community Bank on her group’s efforts to address the sales practice issues, as well as an update from the CRO on how Corporate Risk was bolstering oversight of Wells Fargo’s sales practices. The board also discussed bringing in a consulting firm to conduct an analysis of customer harm resulting from improper sales practices.

In December 2015, the chair of the Risk Committee and the board’s lead independent director met with Wells Fargo’s CEO – who was also the board chair at that time – to express their view that the head of the Community Bank was unfit to continue serving in her current capacity. They felt as though she had misled the board on the severity of the sales practices issue and was resistant to change. By this point, the head of the Community Bank was now reporting directly to Wells Fargo’s new Chief Operating Officer (COO), and he requested that the board grant him six months to assess her performance, a request which most board members considered reasonable.

At the February 2016 Risk Committee meeting, the CRO reported on the growth of the Corporate Risk function and the new initiatives designed to address the sales practice issues. That same month, the board’s Human Resources Committee met to determine compensation for 2015 for senior executives, including the head of the Community Bank. Although several board members were unhappy with her performance, most believed the sales practice issue was an isolated one, with only 230 employees in one region having been terminated for misconduct. Wells Fargo’s CEO maintained his intense loyalty to the head of the Community Bank, and advocated that her compensation should be treated no differently from that of the other senior executives. Accordingly, no Wells Fargo executives had their compensation adjusted downward as a result of the sales practice issues.

The board finally received accurate numbers regarding sales integrity violations after asking the Chief Global Ethics Officer to provide a written report to the A&E Committee, which was delivered in May 2016. The report indicated that 1,327 Community Bank employees in 2014, and 960 in 2015, were terminated for sales integrity violations.

Upon the conclusion of the COO’s review of the head of the Community Bank’s performance, the board issued a resolution in July, which immediately removed her from her position and announced she would retire as of December 31, 2016.

In September of 2016, Wells Fargo reached a settlement with the City of Los Angeles, the OCC, and the Consumer Financial Protection Bureau. For the first time, directors learned that approximately 5,300 Wells Fargo employees had been terminated between January 1, 2011, and March 7, 2016, for sales practice violations that included opening over two million unauthorized deposit and credit card accounts and charging some of their customers fees for these unauthorized accounts. The settlement required, among other things, that Wells Fargo pay $185 million in penalties.

Questions

- What are the pros and cons associated with the role of board chair and CEO being held by the same person? What impact, if any, did the fact that the same person held both roles have in this situation?

- Do board members have an obligation to track external items (e.g., news articles, blog posts, consumer complaints) on its own? What about internal items such as exam reports or internal audit reports?

- Should a board understand how lower level employees, not just executives, get compensated?

- How far should a board go in making determinations about the hiring and firing of senior executives?

- How would you assess the board’s performance after the LA Times story was published?

Post-Settlement

The public was immediately outraged by the findings contained within the settlement. As the flow of damning information increased, Wells Fargo was hit from all sides with a torrent of adverse publicity and legal actions. Wells Fargo’s CEO was called to testify before Congress, where he downplayed the severity of the problem by repeatedly emphasizing that the 5,300 terminated employees represented only 1% of the Bank’s workforce. To the public, he appeared tone deaf to the issues of legality and trust raised by the phony accounts. Shortly after his Congressional testimony, he resigned at the behest of the board. The former COO, a longtime Wells Fargo employee, was promoted to CEO.

Meanwhile, the company was taking a pounding in the press, social media and the marketplace. Wells Fargo’s competitors were not shy about using the accounts scandal as a marketing tool, and the Bank’s account opening statistics plummeted. Further, a number of existing customers closed their accounts in protest.

After the settlement, the board took prompt action. It reviewed the facts surrounding the scandal, immediately dismissed the former head of the Community Bank, and forfeited a portion of her compensation as well as the compensation of the former CEO. The board encouraged management to discontinue all retail product sales goals, which management announced on September 13, 2016, effective January 1, 2017. But after the CEO’s disastrous Congressional testimony, the effective date for discontinuing sales goals was moved up to October 1, 2016. The board was also quick to issue a resolution which required the board chairman to be an independent director.

The board retained independent counsel to do a thorough investigation of the scandal and intends to act on the findings of such report. In addition, shortly before the annual shareholders meeting, Wells Fargo’s primary federal regulator, the OCC, issued a report in which it admitted serious mistakes were made in its oversight of Wells Fargo. The report indicated that the agency did not take seriously enough whistler-blower complaints related to Wells Fargo’s sales practices, of which there were many.

Shareholder Reaction

Although the publicity has been awful, Wells Fargo remains a viable institution. That said, its common stock underperformed general stock market indices, financial services indices, and its peers in the months immediately after the scandal.

Worryingly, two proxy advisory firms recommended that shareholders should vote against current Wells Fargo directors because of their negligence in office. Wells Fargo’s board did take some comfort in the news that Warren Buffet, although critical of the company’s handling of the issue, was supportive of the management and board, and would vote his shares in favor of management at the shareholders meeting.

The verdict of the market, and public, on Wells Fargo is that its actions were too little and too late. At the annual meeting, several angry shareholders addressed the board out of turn, with one screaming: “Tell us what you knew and when you knew it!” Ultimately, all board members were reelected, although four received less than 60% of votes cast – a remarkably low number considering that all board members were running unopposed and had received at least 95% of votes cast during last year’s annual meeting. In the aftermath of the shareholders meeting, one prominent Democratic Senator called on the Federal Reserve to remove twelve of the Bank’s board members. Such a move is unlikely, but the demand itself is reflective of the public’s outrage over what happened and the board’s failure to prevent, or stop sooner, the offending activity.

Righting the Ship

In the aftermath of the scandal and annual meeting debacle, the board meets to assess Wells Fargo’s situation and discuss next steps.

Question

If you were a remaining board director, what would you propose to get the firm back on track?

http://www.bettermarkets.com/newsroom/fact-sheet-why-wells-fargo-ceo-and-board-must-go-whitewash-cover-and-dereliction-duty

Pingback: Many Leaders Routinely Make These 4 Mistakes - Do You? - Techylawyer Blog

Pingback: 5 assignment | Management homework help - Nerd My Paper

Pingback: 3.5 exercise: virtuous business assignment - assignmentmillers.com