“As a Duke MBA, I’ve seen firsthand how technology is reshaping legacy financial structures like defined benefit plans. At Fuqua, we were taught to think strategically about long-term value, and today’s tech—whether it’s AI-powered risk modeling or participant-facing platforms—is turning pension plans from administrative burdens into strategic assets for both employers and beneficiaries.” – Jordan K., MBA, Duke Fuqua School of Business

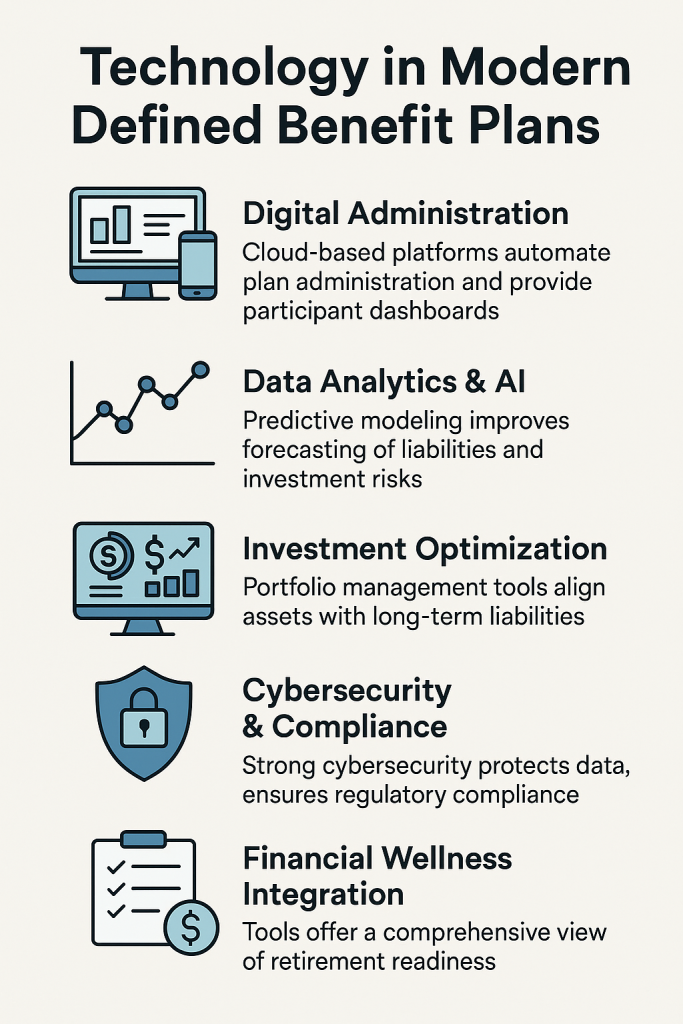

Technology is playing a significant role in modernizing defined benefit plans, helping make them more efficient, transparent, and appealing to both employers and participants.

Here’s how:

1. Digital Administration & Recordkeeping

-

Cloud-based platforms simplify plan administration, compliance, and participant communications.

-

Tools like BenTech, PlanSponsorLink, and custom TPA dashboards automate contribution tracking, benefit accruals, and actuarial reporting.

-

Participant portals offer real-time access to accrued benefits, funding status, and retirement projections.

2. AI and Predictive Analytics

-

Actuarial firms and pension administrators use AI-driven modeling to forecast future liabilities, investment risks, and funding gaps.

-

Predictive tools help optimize contribution strategies and asset-liability matching (ALM), especially under fluctuating market conditions.

3. Investment Optimization

-

Automated portfolio management platforms (e.g., BlackRock’s Aladdin, State Street’s TruView) are used to align investments with long-term pension liabilities.

-

Risk analytics tools identify potential shortfalls and reallocate assets proactively to preserve funding ratios.

4. Cybersecurity & Compliance Tech

-

Strong cybersecurity frameworks and blockchain-based identity systems are being introduced to protect participant data and ensure regulatory compliance (e.g., ERISA, PBGC).

5. Integration with Financial Wellness Tools

-

DB plans are increasingly embedded in broader employee financial wellness ecosystems, showing workers their total retirement picture (including DC, HSA, and Social Security).

6. Custom Plan Design Software

-

Tools allow actuaries or plan sponsors to model custom DB plan designs in real time (cash balance vs. traditional, multi-employer vs. single-employer).

-

Simulation features help business owners understand tax advantages, maximum contributions, and succession planning benefits.

Summary

Modern DB plans are being reimagined through tech: automating compliance, enhancing forecasting, securing data, and providing users with a real-time view of retirement readiness.