Courtesy of Tor-Erik Bakke, Jeffrey Black, Hamed Mahmudi, and Scott Linn

Are the professional networks of corporate directors valuable? More connected directors may have better information and more influence, which can increase firm value. However, directors with larger networks may also be busy or spread value-decreasing management practices. To identify the effect of director networks on firm value, we use the unexpected deaths of well-connected directors as a shock to the networks of interlocked directors. By looking at the post-announcement stock price returns, and using a difference-in-differences methodology, we find that this negative shock to director networks reduces firm value. This evidence suggests that director networks are valuable.

The Challenge

To determine whether the benefits of connected boards on average outweigh the costs, we use an exogenous shock, which reduces board connectedness, to examine if director networks are indeed valuable or, conversely, if they destroy value. Specifically, we use the unexpected deaths of directors as a negative shock to the networks of directors who were either currently or previously sitting on the same board as the deceased director (interlocked directors). The death of a director severs the network tie between the interlocked director and the deceased director’s network. This, in turn, represents a negative shock to the director networks of other firms on whose board the interlocked director also sits (director-interlocked firms). Using a difference-in-differences methodology, we find that this negative shock to director networks reduces firm value, suggesting that director networks are indeed value-enhancing.

As we have suggested, the impact of any director on the companies the director is associated with should be enhanced when that director has many and more important connections – what we refer to as a better-connected director. Consistent with this hypothesis, recent research finds evidence of a positive association between director networks and firm value (Larcker, So, and Wang, 2013). However, because of issues of endogeneity, researchers have yet to convincingly establish a causal relation between the choice of a director and firm value. For example, it is challenging to identify the impact of a better-connected director because better connected directors may choose to only make themselves candidates for board seats on better-performing firms, or conversely, better-performing firms may only seek out the best-connected directors. Likewise, the investment opportunities available to the firm may be correlated with both director connectedness and firm value further confounding inferences. Moreover, the greater experience and talent of well-connected directors further complicate isolating the effect of directors’ connectedness on firm value.

The Solution

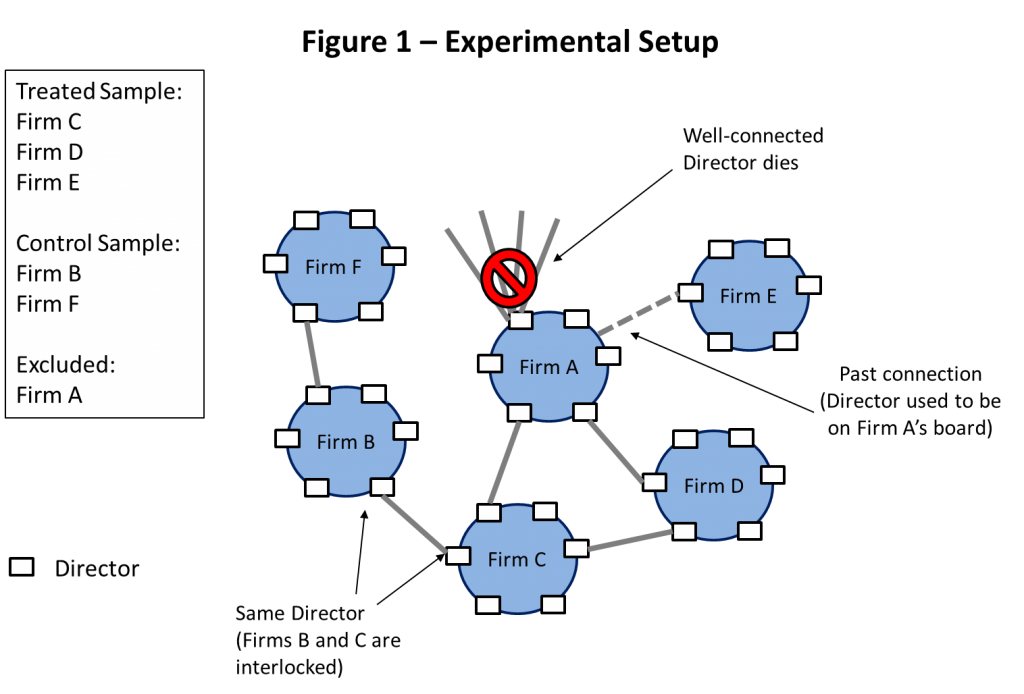

Our experimental design (illustrated in Figure 1) helps overcome the endogeneity problem elaborated earlier. First, the unexpected death of interlocked directors is unlikely to be correlated with value-relevant omitted variables. Second, the randomness of the unexpected deaths in our sample results in estimates that are not subject to the bias caused by the endogenous matching between directors and firms. Finally, unlike Larcker, So, and Wang (2013) and Fogel, Ma, and Morck (2014), who studied how the unexpected death of directors affects the deceased director’s home firm, we focus on the value of interlocked firms. This allows us to separate the effect of board connectedness on firm value from the effect of other value-relevant director attributes.

Why Connected Directors?

Well-connected directors can be thought of as directors who are central to the network’s flow of information and resources. To assess the value relevance of the deaths of corporate directors, we first compute commonly used measures that capture how central each director is to the network he or she belongs to.[i] Our sample consists of the unexpected deaths of 11 directors, which caused negative shocks to the director networks of 249 directors at 281 interlocked firms. These 281 director-interlocked firms lose access to the deceased director’s network and are therefore considered the treatment group.

Identifying Value Responses

In order to identify the value shock of an interlocked director’s death on the non-home companies he is connected to, the shock to the network must be sufficiently large to create an economically meaningful drop in the board centrality measures of treated firms. To this end, we focus on publicly-traded Canadian firms in the period 2000 to 2012. We use Canadian firms because network shocks, such as the one we examine, are more likely to be economically significant in smaller, more isolated hub-and-spoke type networks, such as Canadian director networks.[ii] Intuitively, this is because the loss of one connected director is more likely to lead to the interlocked firm being cut off from other firms in the network (i.e., becoming less central in the network) in environments characterized by smaller and more crowded networks. In contrast, in a larger and more dispersed network, as is common amongst companies in the US, the loss of a connected interlocked director is likely to have a smaller impact on the interlocked firm. Since such firms are connected through multiple links, the importance of losing a connection (even a relatively important one) is reduced.[iii]

Unexpected Deaths and Connectedness Changes

The shock of an unexpected director’s death to the connectedness of director-interlocked firms is economically and statistically significant. We find that the average degree centrality of treated firms, measured as the number of connections a director has within the network, falls by about 0.3% relative to firms which were unaffected by the director network shock (i.e., control firms) and that are in the same industry and have similar size and centrality prior to the event.[iv] Importantly, this change in the centrality measure due to the network shock likely understates the magnitude of the shock, as this estimated change implicitly assumes that readjusting the network is frictionless. In reality, adjusting one’s network to compensate for the loss of the well-connected director’s network entails significant search costs.

Breaking the Network and Company Value

To test whether the elimination of network ties affects firm value, we examine how the stock prices of the firms losing the network ties (the treated firms) change around the unexpected deaths of directors. We compare the announcement returns of treated firms to the corresponding returns for a matched sample of control firms (similar firms that did not experience a network shock). We show that the shock to director networks, caused by the unexpected death of a director, results in average negative cumulative abnormal returns (CARs) for director-interlocked firms relative to the control sample. Specifically, we find that relative to control firms, treated firms lost, on average, $20.42 million in market capitalization on the day the death is announced.

Although we construct a matched sample to mitigate the possibility that observable firm characteristics explain differences in CARs between treated and matched control firms, this may not fully account for cross-sectional relationships between the firm characteristics and abnormal returns. We therefore also include firm characteristics as control variables in the regression of the CARs on firm connection with the deceased directors. When controlling for other factors that might have influenced the price reaction, the resulting conclusion is that the average loss in value is $15.71 million, which is still highly statistically significant.[v] Therefore, after controlling for systematic risk factors, as well as relative to matched control firms, our findings indicate that the loss of network connections led to a statistically and economically significant decline in firm value of director-interlocked firms.[vi]

The key identifying assumption underlying the DID estimation technique is that the parallel trends assumption is satisfied, that is, in the absence of treatment, both treated and control firms should experience parallel trends in the outcome variable. As suggested by Roberts and Whited (2012), because the parallel trends assumption is untestable, we perform a falsification test to further test the internal validity of our experimental setting and to mitigate concerns that our results are found purely by chance. In these falsification tests, we find no evidence of significant differences in the firm value of the treated and control firms around the placebo events. These results suggest that our results are due to the unexpected death of the 11 deceased directors rather than random chance or any fundamental difference between the treated and control firms, which could bias our results.

Due to our identification strategy, our findings rest primarily on variation in stock price reactions of interlocked firms around unexpected deaths of directors. Therefore, our results are an estimate of the value shock due to the loss of the connection between the deceased director and his or her expected replacement. If the deceased director is replaced with a director with a similar level of connectedness within the network of directors and the market is able to perfectly foresee this outcome, there should be no meaningful disruption to the network of the interlocked director and therefore, no drop in the value of the treated firm. However, this should create a bias against finding any meaningful change in the value of the interlocked firms due to the unexpected director deaths. The fact that we find a significant decrease in the value of interlocked firms despite this potential bias indicates that director connections have value and that the replacement of deceased directors with others that reestablish the broken network is, on average, not possible.[vii]

Is it Due to Director Busyness?

We investigate whether our results are driven by an increase in the busyness of interlocked directors. This is important as our results could be confounded by the fact that the unexpected death of a director has two effects on interlocked directors: (i) a negative shock to the director’s network and (ii) an increase in the director’s busyness (i.e., workload, that creates inefficiencies) (Falato, Kadyrzhanova, and Lel, 2014). To separate these two effects, we redefine treated firms to only include firms who lost a past connection. These firms have at least one director who previously served on the same board as the deceased director (a past connection), but do not currently share a director with the deceased director’s firm(s). As the loss of a past connection does not increase the busyness of the interlocked director but does affect the connectedness of the director, this classification enables us to better isolate the first effect (i).

We find that our results continue to hold using only the loss of past connections, which suggests that our results are not simply an artifact of an increase in director busyness but are at least in part due to a reduction in the connectedness of the firm’s directors.

Is it Due to An Increase in Financial Constraints?

We also explore whether our results are driven by the loss of a connection to financial institutions, and therefore access to financing. To test this, we omit network shocks that involve the passing of a bank director. We find that our result, that adverse network shocks reduce the firm value, persists despite no change in interlocked firms’ direct connections to bank directors. This suggests that the value of director networks is not solely due to connections to banks and better access to finance.

The Uniqueness of the Study

Our study stands apart from others in the literature and makes new and novel contributions to the overall understanding of the value of a director. First, we contribute to the broad literature on the value of connections. Faccio and Parsley (2009) show that political connections are valuable; Hochberg, Ljungqvist, and Lu (2007) find that more connected venture capital firms perform better; Cohen, Frazzini, and Malloy (2008) and Cohen, Frazzini, and Malloy (2010) show that connections based on shared educational backgrounds are valuable to mutual fund managers and equity research analysts respectively; Engelberg, Gao, and Parsons (2013) provide evidence that CEOs are paid more when their network connections are more valuable while Faleye, Kovacs, and Venkateswaran (2012) show that better-connected CEOs innovate more. We add to this literature by showing that firms benefit from having better-connected boards.

Second, our paper extends the literature that studies the influence of director networks generally. This literature uncovers positive as well as negative implications of having a well-connected board. Barnea and Guedj (2009) and Renneboog and Zhao (2011) show that firms with better-connected directors pay their CEOs more, but these firms also grant pay packages with lower pay-performance sensitivity. In addition, Barnea and Guedj (2009) show that well-connected directors are more likely to be recruited to more directorships but provide softer monitoring of management.

On the positive side, Horton, Millo, and Serafeim (2012) show that the positive link between connectedness and director compensation is not due to the connected directors using their power to extract economic rents, but rather that firms compensate directors for their network connections. Moreover, Fogel, Ma, and Morck (2014) show that powerful independent directors are associated with fewer value-destroying M&A bids, more high-powered CEO compensation, more accountability for poor performance, and less earnings management. Helmers, Patnan, and Rau (2015) find that better-connected boards spend more on R&D and obtain more patents. Shelley and Tice (2015) demonstrate that firms with well-connected boards are less likely to both misstate their annual financial statements and adopt practices that reduce financial reporting quality. Intintoli, Kahle, and Zhao (2018) find that the connectedness of independent, non-co-opted audit committee members has a positive effect on financial reporting quality and accounting conservatism. Although we do not investigate the effect of director networks on corporate policy, we show within the context of a carefully controlled empirical design, that overall well-connected boards increase firm value.

Third, we add to the literature that studies the link between board connectedness and firm value. Several studies have found positive associations between the connectedness of a firm’s board of directors and its operating performance (Hochberg, Ljungqvist, and Lu, 2007; Horton, Millo, and Serafeim, 2012; Crespí-Caldera and Pascual-Fuster, 2015). Moreover, Larcker, So, and Wang (2013) show that firms with more connected boards have significantly higher risk-adjusted returns than firms with less connected boards. Stern (2015) demonstrates that better-connected board chairmen (but not directors in general) are associated with more value creation for their firms. In contrast to these papers, we provide causal evidence that having better-connected directors increases firm value.

Fogel, Ma, and Morck (2014) and Intintoli, Kahle, and Zhao (2018) provide evidence that the unexpected death of more connected directors negatively affects the value of the powerful director’s firm. However, unlike in our paper, they are unable to distinguish whether the decline in value was due to the loss of the deceased director’s talent or due to the loss of the deceased director’s connections. As connected directors are likely to be talented, this may confound inference. We get around this challenge by examining the effect of the unexpected death on director-interlocked firms only. Thus, unlike previous studies, we are able to isolate the direct effect of director networks on firm value.

Finally, we contribute to the literature that studies the value a director provides to a firm (Nguyen and Nielson, 2010). Related to our article, Burt, Hrdlicka, and Harford (2019) study the commonality in idiosyncratic returns of firms with interlocked directors. They show that, on average, a director’s influence causes variation in the firm value of almost 1% per year. We extend their findings by separating the effect of the director’s connections on firm value from the effect of his or her other attributes such as talent and experience. Viewed in this light, our smaller estimate (0.3-0.4%) seems reasonable as it only captures the value of the director’s network whereas their estimate captures the overall value impact of a typical director (due to, e.g., connections, talent, experience, etc.)

Our paper is also related to other studies (Fracassi and Tate, 2012 and Fracassi, 2017) that use director death as a source of exogenous variation to network connectedness. Using changes in board composition due to director death and retirement for identification, Fracassi and Tate (2012) find that CEO-director ties reduce the firm value, particularly in the absence of other governance mechanisms to substitute for board oversight. The scope of their paper is fundamentally different from ours in that they focus on ties between CEO and directors while we study the value implication of connections among directors that facilitate the flow of information to the board room. Fracassi (2017) finds that the more two companies share connections among executives and directors, the more similar their capital investments are. To address endogeneity concerns, Fracassi (2017) finds that companies invest less similarly when an individual connecting them dies. Again, the focus of this paper is very different from ours as Fracassi studies similarities in corporate policies due to connections among top executives and directors. In sharp contrast, we study shareholder value implications of connections within the director’s network and propose a novel use of the director’s unexpected death for identification of the value implications of director-to-director network connections.

The Conclusion

Are the networks that exist between corporate directors valuable to the companies they oversee? The conclusion of our empirical analysis is “Yes.”

[i] We measure connections in our network at the finer director level before aggregating it at a firm level. This allows us to accurately account for loss of multiple connections by multiple directors of the interlocked firms due to the sudden death of each director.

[ii] With the exception of these director network differences between the US and Canada, other institutional features of publicly traded firms (e.g.., board characteristics etc.) are similar in the US and Canada. This homogeneity reinforces the external validity of our findings. Moreover, most countries tend to have director networks that are more similar to Canada than to the US, which also suggests that our results may have external validity beyond Canada.

[iii] For example, in our sample of publicly traded Canadian firms in 2012, on average every director has 11.69 connections with other directors in the network. In contrast, in the equivalent sample of publicly traded firms in the US in 2012, a director, on average, has 83.30 connections with other directors in the network. This suggests a loss of a connection and in particular a connection with a well-connected director in Canada may result in a relatively larger loss in network centrality measures compared to the loss of a director connection among US firms.

[iv] Assuming mean firm-level degree centrality of 26.82 and mean board size of 11.63, this equates to 0.09 connections lost per director, or 1 connection lost. This is consistent with that fact that the sudden death results in the loss of at least 1 total connection (or greater, if multiple directors were connected to the deceased director).

[v] Although this estimate (0.3%) may seem small, it is useful to relate it to the loss in board connectedness due to the unexpected death of the interlocked director which is of a similar magnitude (0.3%). If we think in terms of elasticities, the percentage change in firm value divided by the percentage change in board connectedness is about 1. Therefore, a reduction of 1% in board connectedness leads to a 1% reduction in firm value. Therefore, the loss of director network connections seems to have a significant impact on firm value.

[vi] One possible concern is that the exclusion of board centrality measures in our main specification biases our results. Therefore we alternatively run simple difference regressions of changes in board centrality measures on abnormal returns on the day the death is announced and find that our main findings continue to hold.

[vii] However, it can also be argued that this bias may be relatively small. First, the directors replacing the 11 deceased directors have centrality measures that are lower than those of the deceased directors on average. Replacement directors have 16.34% lower degree centrality, 48.53% lower betweenness centrality, 0.19% lower closeness centrality, and 12.98% lower eigenvector centrality than their deceased predecessors. Second, it takes significant time to replace lost directors implying that the firm does not have access to the replacement’s network for an extended period of time.